8995 Tax Form: Your Key to QBI Deduction Success

And so, dear reader, let us embark on this journey together, delving into the 2022 IRS Form 8995 and exploring its peculiarities and solutions for unusual cases. Fear not, for with knowledge comes power, and with power, the ability to file your taxes with confidence!

Form 8995: The Unexpected Cases

Like the fantastical worlds found in classic literature, tax laws are brimming with surprises. As a small business owner, you may find yourself pondering the peculiar instances in which one must file this elusive fillable Form 8995. Here are some unusual cases that might just tickle your curiosity:

The Curious Case of the Part-Time Artisan

Imagine a skilled artisan, weaving magic into their creations during the moonlit hours, while also working a full-time day job. They're unsure if their part-time endeavors qualify for the QBI deduction. Fear not, dear artisan! Part-time or full-time, if your business is a sole proprietorship, partnership, S corporation, or a qualifying trust or estate, you may be eligible for this deduction. Simply complete the IRS Form 8995 instructions, and watch as the deduction weaves its way into your taxable income.

The Enchanted Tale of the Foreign Investor

In this story, a foreign investor owns a share in an American business. The question is, can they too benefit from the QBI deduction? The answer lies within the enchanting pages of Form 8995. If the foreign investor has effectively connected income (ECI) with a U.S. trade or business, they too can cast their spell and claim the deduction. But beware, for the complexities of international tax laws may require further guidance from a tax professional.

Oops! A Guide to Correcting Mistakes on Form 8995

Alas, like a tragic hero in a classic novel, we are all prone to making mistakes. Fret not, for there is a way to right the wrongs committed on your Form 8995. Follow this guide, and you shall be redeemed:

- Identify the error – Is it a simple arithmetic mistake or a more complex oversight?

- Amend the form – If the error affects other forms or schedules, ensure they too are corrected.

- Complete Form 1040X – The Amended U.S. Individual Income Tax Return will set things right.

- Attach the corrected Form 8995 to 1040X copy – This union shall rectify your misstep.

- File your amended return – Send your corrected forms to the IRS, and all shall be well once more.

And so, dear reader, we have come to the end of our whimsical journey through the land of federal tax form 8995. With these tales and solutions in hand, you are now better equipped to navigate the labyrinth of tax laws and find your way to a successful filing. Godspeed, and may you find your tax deductions plentiful!

Related Forms

-

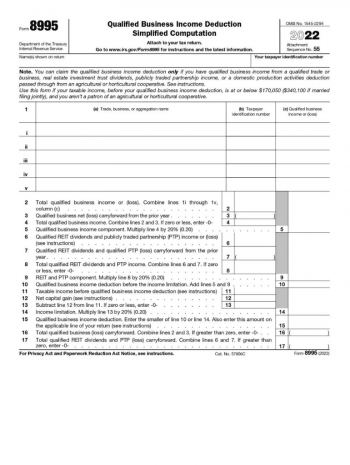

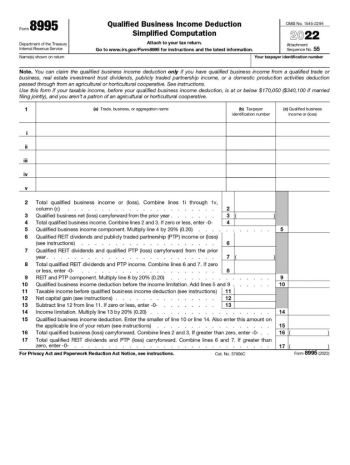

![image]() 8995 The IRS Form 8995 is a crucial income tax document that taxpayers need to understand and complete accurately. The document pertains to calculating and documenting the Qualified Business Income (QBI) deduction, which can significantly impact a taxpayer's overall liability. In essence, the QBI deduction allows eligible individuals, estates, and trusts to claim a deduction of up to 20% of their qualified business income from a relevant trade. By appropriately utilizing tax form 8995 for 2022, taxpa... Fill Now

8995 The IRS Form 8995 is a crucial income tax document that taxpayers need to understand and complete accurately. The document pertains to calculating and documenting the Qualified Business Income (QBI) deduction, which can significantly impact a taxpayer's overall liability. In essence, the QBI deduction allows eligible individuals, estates, and trusts to claim a deduction of up to 20% of their qualified business income from a relevant trade. By appropriately utilizing tax form 8995 for 2022, taxpa... Fill Now -

![image]() IRS Form 8995 for 2022 (Printable PDF) Effortlessly Obtain the Printable Form 8995 from Our User-Friendly Website Are you ready to tackle IRS Form 8995? Look no further! Our website offers printable Form 8995 in a blank PDF format, making it incredibly easy to obtain and fill out. With our handy navigation, you'll have the federal form 8995 in no time. Simply visit our website, locate the IRS Form 8995 PDF, and download it to your device. It's that easy! Now, let's dive into the rules you need to follow to fill out QBI deduction correctly. Follow These Rules to Fill Out Form 8995 Appropriately When filling out the federal form 8995, it's essential to adhere to the following guidelines to ensure accuracy: Read the form instructions carefully before starting. Double-check the tax year and ensure you're using the correct version of the document. Provide accurate and complete information for your business, including the Employer Identification Number (EIN). Calculate your Qualified Business Income (QBI) and deductions accurately, following the IRS guidelines. Don't forget to include any relevant supporting documents, such as profit and loss statements or balance sheets. Keep a copy of the completed template for your records. By following these rules, you can confidently fill out a business income deduction document and avoid any potential mistakes or delays in processing. File Form 8995 Correctly with These Easy Steps To ensure a smooth filing process, follow this simple list of steps: Download the blank PDF for the relevant financial year from our website and print it out. Fill out the blank sample accurately, following the rules mentioned above. Double-check your calculations and ensure all required fields are complete. Attach any necessary supporting documents. Sign and date the template. Submit the completed example, along with your individual tax return, to the IRS by the due date. By following these steps, you'll be able to file your QBID without any hiccups, ensuring timely and accurate submission. Don't Miss the Form 8995 Due Date It's crucial to be aware of the due date for submitting your federal Form 8995. Generally, the deadline to file Form 8995 is the same as your individual income tax return, which is typically April 15th. If you're unable to file by the due date, you may request an extension from the IRS. However, it's always best to file on time to avoid penalties and potential delays in processing. Fill Now

IRS Form 8995 for 2022 (Printable PDF) Effortlessly Obtain the Printable Form 8995 from Our User-Friendly Website Are you ready to tackle IRS Form 8995? Look no further! Our website offers printable Form 8995 in a blank PDF format, making it incredibly easy to obtain and fill out. With our handy navigation, you'll have the federal form 8995 in no time. Simply visit our website, locate the IRS Form 8995 PDF, and download it to your device. It's that easy! Now, let's dive into the rules you need to follow to fill out QBI deduction correctly. Follow These Rules to Fill Out Form 8995 Appropriately When filling out the federal form 8995, it's essential to adhere to the following guidelines to ensure accuracy: Read the form instructions carefully before starting. Double-check the tax year and ensure you're using the correct version of the document. Provide accurate and complete information for your business, including the Employer Identification Number (EIN). Calculate your Qualified Business Income (QBI) and deductions accurately, following the IRS guidelines. Don't forget to include any relevant supporting documents, such as profit and loss statements or balance sheets. Keep a copy of the completed template for your records. By following these rules, you can confidently fill out a business income deduction document and avoid any potential mistakes or delays in processing. File Form 8995 Correctly with These Easy Steps To ensure a smooth filing process, follow this simple list of steps: Download the blank PDF for the relevant financial year from our website and print it out. Fill out the blank sample accurately, following the rules mentioned above. Double-check your calculations and ensure all required fields are complete. Attach any necessary supporting documents. Sign and date the template. Submit the completed example, along with your individual tax return, to the IRS by the due date. By following these steps, you'll be able to file your QBID without any hiccups, ensuring timely and accurate submission. Don't Miss the Form 8995 Due Date It's crucial to be aware of the due date for submitting your federal Form 8995. Generally, the deadline to file Form 8995 is the same as your individual income tax return, which is typically April 15th. If you're unable to file by the due date, you may request an extension from the IRS. However, it's always best to file on time to avoid penalties and potential delays in processing. Fill Now -

![image]() Fillable Form 8995 Get Your Hands on the Fillable IRS Form 8995 PDF with Ease Hey there! Need help with your income tax form 8995? Look no further. Our user-friendly website with handy navigation is here to make your life easier. Just follow these simple steps to obtain the fillable Form 8995 PDF: Visit our website and follow the link at the top of the screen to obtain the free template for the 2022 tax year. Download the PDF to your device, and voila! You're all set to begin filling it out Your Ultimate Guide to Filling Out Form 8995 Like a Pro Once you've got the relevant Form 8995 on your device, it's time to fill it out. Here's a bullet list of rules to help you ace it: First things first, make sure you're using the correct tax year's form Double-check your eligibility for the Qualified Business Income (QBI) deduction Determine if you need to use the simplified worksheet or the detailed computation Fill in all required fields, including SSN, name, and address Enter QBI amounts for each business you own Calculate the QBI deduction using the instructions provided Review and verify all your inputs before moving on to submission Submitting Your Form 8995 with Confidence Now that you've filled out your IRS Form 8995, it's time to file it correctly. Here's how: Attach Form 8995 to your completed copy of the 1040, 1040-SR, or 1040-NR Submit the entire package electronically or mail it to the appropriate IRS address Keep a copy of the completed example for your records – you never know when you might need it! Avoid These Common Federal Form 8995 Mistakes Even the best of us can make mistakes when dealing with tax documents. But don't worry, we've got your back! Check out these common errors people may face while working with IRS Form 8995: Using the wrong tax year's PDF – double-check before you begin filling it out Not verifying eligibility for the QBI deduction – this can lead to incorrect calculations and potential penalties Overlooking required fields or entering incorrect information – always review your inputs Not calculating the QBI deduction correctly – follow the instructions provided on the template and consult a tax professional if needed Failing to attach IRS Form 8995 to your tax return – this can cause delays in processing So there you have it! With this handy guide, you're all set to tackle your income tax form 8995 with confidence. Remember, our website is here to help you find the necessary forms, like the IRS Form 8995 PDF, and provide you with useful tips and resources to make tax season a breeze. Happy filing! Fill Now

Fillable Form 8995 Get Your Hands on the Fillable IRS Form 8995 PDF with Ease Hey there! Need help with your income tax form 8995? Look no further. Our user-friendly website with handy navigation is here to make your life easier. Just follow these simple steps to obtain the fillable Form 8995 PDF: Visit our website and follow the link at the top of the screen to obtain the free template for the 2022 tax year. Download the PDF to your device, and voila! You're all set to begin filling it out Your Ultimate Guide to Filling Out Form 8995 Like a Pro Once you've got the relevant Form 8995 on your device, it's time to fill it out. Here's a bullet list of rules to help you ace it: First things first, make sure you're using the correct tax year's form Double-check your eligibility for the Qualified Business Income (QBI) deduction Determine if you need to use the simplified worksheet or the detailed computation Fill in all required fields, including SSN, name, and address Enter QBI amounts for each business you own Calculate the QBI deduction using the instructions provided Review and verify all your inputs before moving on to submission Submitting Your Form 8995 with Confidence Now that you've filled out your IRS Form 8995, it's time to file it correctly. Here's how: Attach Form 8995 to your completed copy of the 1040, 1040-SR, or 1040-NR Submit the entire package electronically or mail it to the appropriate IRS address Keep a copy of the completed example for your records – you never know when you might need it! Avoid These Common Federal Form 8995 Mistakes Even the best of us can make mistakes when dealing with tax documents. But don't worry, we've got your back! Check out these common errors people may face while working with IRS Form 8995: Using the wrong tax year's PDF – double-check before you begin filling it out Not verifying eligibility for the QBI deduction – this can lead to incorrect calculations and potential penalties Overlooking required fields or entering incorrect information – always review your inputs Not calculating the QBI deduction correctly – follow the instructions provided on the template and consult a tax professional if needed Failing to attach IRS Form 8995 to your tax return – this can cause delays in processing So there you have it! With this handy guide, you're all set to tackle your income tax form 8995 with confidence. Remember, our website is here to help you find the necessary forms, like the IRS Form 8995 PDF, and provide you with useful tips and resources to make tax season a breeze. Happy filing! Fill Now -

![image]() IRS Form 8995 Instructions An Introductory Guide to IRS Form 8995 Instructions and Common Mistakes to Avoid As a taxpayer in the United States, you may have come across various tax forms and instructions. One such essential document that has gained significance in recent years is the IRS Form 8995. In this article, we'll delve into the purpose of this document, when to use it, essential details to consider, and common mistakes to avoid. Let's dive into the world of federal tax form 8995! Understanding the Purpose and Use of IRS Form 8995 IRS Form 8995, also known as the Qualified Business Income Deduction Simplified Computation, serves a crucial purpose in the tax filing process. It is used to calculate the qualified business income (QBI) deduction for eligible taxpayers with pass-through businesses such as sole proprietorships, partnerships, and S corporations. The 2022 IRS Form 8995 is an integral part of the income tax filing process for those who qualify for this deduction. Essential Details to Consider When Working with the 8995 Template When completing the IRS Form 8995, it is vital to pay attention to specific details to ensure accuracy. Here's a list of essential points to consider while working with the 8995 template: Ensure you meet the eligibility criteria for the QBI deduction, such as having a qualified trade or business or receiving qualified REIT dividends or PTP income. Accurately calculate your total QBI from all qualified trades or businesses. Do not forget to include any relevant adjustments to QBI, such as losses disallowed under section 461(l). Consider the limitations based on taxable income, W-2 wages, and the unadjusted basis immediately after acquisition (UBIA) of qualified property. Complete all required sections of the 8995 template, including the QBI component worksheet if necessary. Common Mistakes and Tips to Avoid Them When Completing IRS Form 8995 As with any tax document, taxpayers make common mistakes when completing the blank 8995 template. Here are some tips to avoid those errors: Incorrectly calculating QBI or not including all eligible income sources.Thoroughly review the income tax form 8995 instructions to ensure accurate calculations and inclusion of all qualifying income sources. Not considering the limitations from taxable income, W-2 wages, and UBIA of qualified property.Review the relevant sections of the IRS Form 8995 instructions to understand how these limitations apply to your situation. Failing to complete the required sections or worksheets of IRS Form 8995.Carefully read the instructions and use the 8995 example to guide you through the completion process. Not filing the completed QBI deduction on time or with the correct tax return.Be aware of the tax filing deadlines and ensure that you file Form 8995 with your individual income tax return. Fill Now

IRS Form 8995 Instructions An Introductory Guide to IRS Form 8995 Instructions and Common Mistakes to Avoid As a taxpayer in the United States, you may have come across various tax forms and instructions. One such essential document that has gained significance in recent years is the IRS Form 8995. In this article, we'll delve into the purpose of this document, when to use it, essential details to consider, and common mistakes to avoid. Let's dive into the world of federal tax form 8995! Understanding the Purpose and Use of IRS Form 8995 IRS Form 8995, also known as the Qualified Business Income Deduction Simplified Computation, serves a crucial purpose in the tax filing process. It is used to calculate the qualified business income (QBI) deduction for eligible taxpayers with pass-through businesses such as sole proprietorships, partnerships, and S corporations. The 2022 IRS Form 8995 is an integral part of the income tax filing process for those who qualify for this deduction. Essential Details to Consider When Working with the 8995 Template When completing the IRS Form 8995, it is vital to pay attention to specific details to ensure accuracy. Here's a list of essential points to consider while working with the 8995 template: Ensure you meet the eligibility criteria for the QBI deduction, such as having a qualified trade or business or receiving qualified REIT dividends or PTP income. Accurately calculate your total QBI from all qualified trades or businesses. Do not forget to include any relevant adjustments to QBI, such as losses disallowed under section 461(l). Consider the limitations based on taxable income, W-2 wages, and the unadjusted basis immediately after acquisition (UBIA) of qualified property. Complete all required sections of the 8995 template, including the QBI component worksheet if necessary. Common Mistakes and Tips to Avoid Them When Completing IRS Form 8995 As with any tax document, taxpayers make common mistakes when completing the blank 8995 template. Here are some tips to avoid those errors: Incorrectly calculating QBI or not including all eligible income sources.Thoroughly review the income tax form 8995 instructions to ensure accurate calculations and inclusion of all qualifying income sources. Not considering the limitations from taxable income, W-2 wages, and UBIA of qualified property.Review the relevant sections of the IRS Form 8995 instructions to understand how these limitations apply to your situation. Failing to complete the required sections or worksheets of IRS Form 8995.Carefully read the instructions and use the 8995 example to guide you through the completion process. Not filing the completed QBI deduction on time or with the correct tax return.Be aware of the tax filing deadlines and ensure that you file Form 8995 with your individual income tax return. Fill Now -

![image]() Form 8995 - Qualified Business Income Deduction A Comprehensive Guide to Tax Form 8995: Everything You Need to Know Hey there, fellow freelancers and self-employed buddies! We all know that managing our finances and taxes can be a real pain. But don't worry, I've got your back! Today, I will be discussing everything you need to know about the tax form 8995, also known as the Qualified Business Income Deduction Simplified Computation document. So, sit back, relax, and let's dive into the world of tax forms together! A Blast from the Past: The History of Tax Form 8995 Before we jump into the ins and outs of tax form 8995, let's take a quick trip down memory lane. The document was introduced as part of the Tax Cuts and Jobs Act (TCJA) in 2017, a significant tax reform that aimed to simplify the tax code and provide tax relief for millions of Americans. One key provision of the TCJA was the creation of the Qualified Business Income (QBI) deduction, which allows eligible taxpayers to deduct up to 20% of their qualified business income. And, you guessed it – 8995 sample is the form used to calculate and claim this deduction. Why Tax Form 8995 Will Be Your New Best Friend in 2023 So, why is federal form 8995 so important for the 2022 and 2023 financial years? Well, the QBI deduction is a game-changer for many small business owners and self-employed individuals like us. It has the potential to significantly reduce our tax liabilities, allowing us to keep more of our hard-earned money. That's why it's crucial to understand how to use income tax form 8995 and take full advantage of the QBI deduction. Exemptions Galore: When You Don't Need to Use IRS Form 8995 If your taxable income is above the threshold for claiming the QBI deduction, you'll need to use 8995-A sample instead. Individuals who are not self-employed or do not have qualified business income are not eligible for the QBI deduction and do not need to file 8995.example Nonresident aliens and certain types of trusts and estates are also not eligible to claim the QBI deduction and therefore do not need to file QBID and the 8995 copy. Unusual Questions about Tax Form 8995 Can I claim the QBI deduction if I'm a social media influencer?Absolutely! As a social media influencer, your income likely falls under self-employment income, making you eligible for the QBID using QBI Form 8995. Make sure you meet the other eligibility requirements and accurately report your income and expenses on your annual return. Should I file business income form 8995 if my spouse has a separate business?Yes, you and your spouse must complete a separate 8995 copy for your respective businesses if you're filing a joint tax return. This is because the QBI deduction is calculated separately for each qualified business. Can I use IRS Form 8995 instructions to claim the QBI deduction for my crypto mining business?Yes, you can! Income from a cryptocurrency mining business is generally considered self-employment revenue, making you eligible to claim the QBI deduction using the 8995 sample. Just make sure to accurately report your mining income and expenses, and follow the form instructions carefully to calculate your deduction. Fill Now

Form 8995 - Qualified Business Income Deduction A Comprehensive Guide to Tax Form 8995: Everything You Need to Know Hey there, fellow freelancers and self-employed buddies! We all know that managing our finances and taxes can be a real pain. But don't worry, I've got your back! Today, I will be discussing everything you need to know about the tax form 8995, also known as the Qualified Business Income Deduction Simplified Computation document. So, sit back, relax, and let's dive into the world of tax forms together! A Blast from the Past: The History of Tax Form 8995 Before we jump into the ins and outs of tax form 8995, let's take a quick trip down memory lane. The document was introduced as part of the Tax Cuts and Jobs Act (TCJA) in 2017, a significant tax reform that aimed to simplify the tax code and provide tax relief for millions of Americans. One key provision of the TCJA was the creation of the Qualified Business Income (QBI) deduction, which allows eligible taxpayers to deduct up to 20% of their qualified business income. And, you guessed it – 8995 sample is the form used to calculate and claim this deduction. Why Tax Form 8995 Will Be Your New Best Friend in 2023 So, why is federal form 8995 so important for the 2022 and 2023 financial years? Well, the QBI deduction is a game-changer for many small business owners and self-employed individuals like us. It has the potential to significantly reduce our tax liabilities, allowing us to keep more of our hard-earned money. That's why it's crucial to understand how to use income tax form 8995 and take full advantage of the QBI deduction. Exemptions Galore: When You Don't Need to Use IRS Form 8995 If your taxable income is above the threshold for claiming the QBI deduction, you'll need to use 8995-A sample instead. Individuals who are not self-employed or do not have qualified business income are not eligible for the QBI deduction and do not need to file 8995.example Nonresident aliens and certain types of trusts and estates are also not eligible to claim the QBI deduction and therefore do not need to file QBID and the 8995 copy. Unusual Questions about Tax Form 8995 Can I claim the QBI deduction if I'm a social media influencer?Absolutely! As a social media influencer, your income likely falls under self-employment income, making you eligible for the QBID using QBI Form 8995. Make sure you meet the other eligibility requirements and accurately report your income and expenses on your annual return. Should I file business income form 8995 if my spouse has a separate business?Yes, you and your spouse must complete a separate 8995 copy for your respective businesses if you're filing a joint tax return. This is because the QBI deduction is calculated separately for each qualified business. Can I use IRS Form 8995 instructions to claim the QBI deduction for my crypto mining business?Yes, you can! Income from a cryptocurrency mining business is generally considered self-employment revenue, making you eligible to claim the QBI deduction using the 8995 sample. Just make sure to accurately report your mining income and expenses, and follow the form instructions carefully to calculate your deduction. Fill Now