IRS Form 8995: Your QBI Deduction Guide

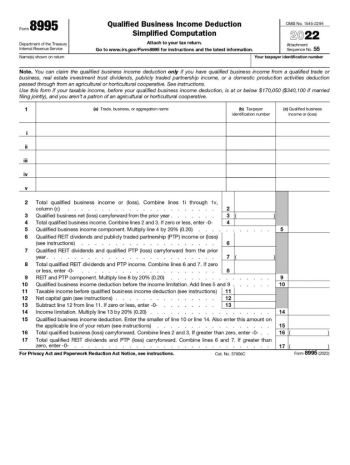

The IRS Form 8995 is a crucial income tax document that taxpayers need to understand and complete accurately. The document pertains to calculating and documenting the Qualified Business Income (QBI) deduction, which can significantly impact a taxpayer's overall liability. In essence, the QBI deduction allows eligible individuals, estates, and trusts to claim a deduction of up to 20% of their qualified business income from a relevant trade. By appropriately utilizing tax form 8995 for 2022, taxpayers can benefit from this substantial deduction and potentially save a considerable amount on their due payments.

In order to ensure the accurate completion of this essential tax form, resources such as form8995.com provide invaluable assistance. The website offers a printable Form 8995, as well as comprehensive instructions and examples to help taxpayers navigate the intricacies of the QBI deduction. Additionally, the IRS Form 8995 PDF available on the site allows users to review the form's layout, structure, and requirements in detail, ensuring a thorough comprehension of the form's purpose and methodology. By accessing and utilizing the materials provided by form8995.com, taxpayers can confidently approach completing their income tax form 8995, optimize their QBI deductions, and potentially secure significant savings for 2022.

The IRS Form 8995 Importance for U.S. Businesses

IRS Form 8995 for 2022 must be filed by individuals, partnerships, S corporations, and trusts or estates that have qualified business income (QBI) from a qualified trade or business. This statement is used to calculate the QBI deduction, which can provide significant tax savings for eligible taxpayers.

Examples of Using QBI Deduction

- One example of a fictional person who must file federal tax form 8995 is Jane Smith. Jane is a freelance graphic designer who runs her own qualified trade or business. In 2022, she earned a substantial amount of QBI from her graphic design services, which makes her eligible to claim the QBID. As a result, Jane will need to follow the IRS Form 8995 instructions in order to properly calculate her deduction and report it on the annual tax return.

- By completing the 2022 IRS Form 8995, Jane can potentially reduce her taxable income and overall tax liability, allowing her to retain more of her hard-earned income. It's important for individuals like Jane, who have qualified business revenue, to understand the requirements and benefits of filing this application to fully take advantage of the tax savings it can provide.

Steps to Fill Out 8995 Tax Form in 2023

- Begin by reviewing the tax form 8995 instructions provided on our website. This will give you an understanding of the form's requirements and eligibility criteria.

- Next, locate the fillable Form 8995 template available for download on our website if you prefer e-filing. Download it to your device for offline use, or use our online filing system. For those who like to keep paper examples for records, we offer printable templates.

- Carefully read through the entire template, noting any sections or fields you may have questions about. If necessary, refer back to the instructions for clarification.

- Fill out Form 8995 with your accurate and up-to-date information, ensuring each field is completed as required. Double-check your data to avoid any errors.

- If using the downloadable template, save your progress periodically to prevent data loss. Follow the prompts and instructions for the online filing system to save your work.

- Once you have completed the sample, review it thoroughly to ensure all information is accurate and all necessary fields have been filled in.

- Finally, submit your completed federal form 8995 as per the instructions given, either by mailing it to the appropriate address or through our online filing system.

The Deadline for QBI Form 8995 Filing

The due date for filing the qualified business income deduction form 8995 is the same as the deadline for submitting your individual annual return, which falls on April 15th annually. This is because the 8995 sample calculates the QBID, which directly impacts your overall financial liability. If you cannot meet this deadline, requesting an extension of time to file your tax return is possible, which would also extend the due date for the 8995 statement. You must submit IRS Form 4868 before the original tax deadline to apply for an extension.

Watch Out for IRS Penalties

- Providing incorrect data on income tax form 8995 can lead to a penalty of 20% of the underpayment amount, which arises due to inaccuracy.

- Deliberately providing false information on the sample may result in a civil fraud penalty, which is 75% of the underpayment attributable to the fraudulent act.

- Failing to file the completed copy on time may lead to a penalty of 5% of the unpaid tax for every month the return is late, up to 25% of the non-paid due.

- Not paying the due on time can result in a penalty of 0.5% of the unpaid tax for each month or week the due remains non-paid, up to a maximum of 25%.

Business Tax Form 8995: Questions & Answers

- What is IRS tax form 8995, and when should I use it?It calculates and reports Qualified Business Income (QBI) deductions for eligible taxpayers. The document is typically used by individuals, estates, and trusts with income received from a qualified trade or business. If you meet the requirements for QBI deductions, you can use our website to download and fill out the blank sample for 2022.

- Where can I find a Form 8995 example to help me understand how to complete it?You can use our website, where we provide comprehensive examples and explanations to guide you through the process. Additionally, you can access our fillable templates to practice filling out the blank worksheet and ensure you understand each section properly.

- How do I access the IRS Form 8995 PDF on your website?Navigate to the designated section on our website. There, you will find a link to download the form for the relevant financial year or use our fillable templates for a more interactive experience.

- Can I print IRS Form 8995 directly from your website?Yes, you can print blank 8995 sample directly from our website. After accessing the form through the PDF or our fillable templates, you can easily print it out for your records or submit it to the IRS.

- How can I be sure that I'm using the most recent version of Form 8995 on your website?We regularly update our tax form collection to ensure you have access to the most recent versions. When you access the 8995 copy on our website, you can rest assured that you are using the latest version provided by the IRS.

Federal Form 8995: Instructions & Samples

-

![image]() IRS Form 8995 for 2022 (Printable PDF) Effortlessly Obtain the Printable Form 8995 from Our User-Friendly Website Are you ready to tackle IRS Form 8995? Look no further! Our website offers printable Form 8995 in a blank PDF format, making it incredibly easy to obtain and fill out. With our handy navigation, you'll have the federal form... Fill Now

IRS Form 8995 for 2022 (Printable PDF) Effortlessly Obtain the Printable Form 8995 from Our User-Friendly Website Are you ready to tackle IRS Form 8995? Look no further! Our website offers printable Form 8995 in a blank PDF format, making it incredibly easy to obtain and fill out. With our handy navigation, you'll have the federal form... Fill Now -

![image]() Fillable Form 8995 Get Your Hands on the Fillable IRS Form 8995 PDF with Ease Hey there! Need help with your income tax form 8995? Look no further. Our user-friendly website with handy navigation is here to make your life easier. Just follow these simple steps to obtain the fillable Form 8995 PDF: Visit our websit... Fill Now

Fillable Form 8995 Get Your Hands on the Fillable IRS Form 8995 PDF with Ease Hey there! Need help with your income tax form 8995? Look no further. Our user-friendly website with handy navigation is here to make your life easier. Just follow these simple steps to obtain the fillable Form 8995 PDF: Visit our websit... Fill Now -

![image]() IRS Form 8995 Instructions An Introductory Guide to IRS Form 8995 Instructions and Common Mistakes to Avoid As a taxpayer in the United States, you may have come across various tax forms and instructions. One such essential document that has gained significance in recent years is the IRS Form 8995. In this article, we'll del... Fill Now

IRS Form 8995 Instructions An Introductory Guide to IRS Form 8995 Instructions and Common Mistakes to Avoid As a taxpayer in the United States, you may have come across various tax forms and instructions. One such essential document that has gained significance in recent years is the IRS Form 8995. In this article, we'll del... Fill Now -

![image]() Form 8995 - Qualified Business Income Deduction A Comprehensive Guide to Tax Form 8995: Everything You Need to Know Hey there, fellow freelancers and self-employed buddies! We all know that managing our finances and taxes can be a real pain. But don't worry, I've got your back! Today, I will be discussing everything you need to know about the ta... Fill Now

Form 8995 - Qualified Business Income Deduction A Comprehensive Guide to Tax Form 8995: Everything You Need to Know Hey there, fellow freelancers and self-employed buddies! We all know that managing our finances and taxes can be a real pain. But don't worry, I've got your back! Today, I will be discussing everything you need to know about the ta... Fill Now